Table of Contents

Tesla Inventory Worth

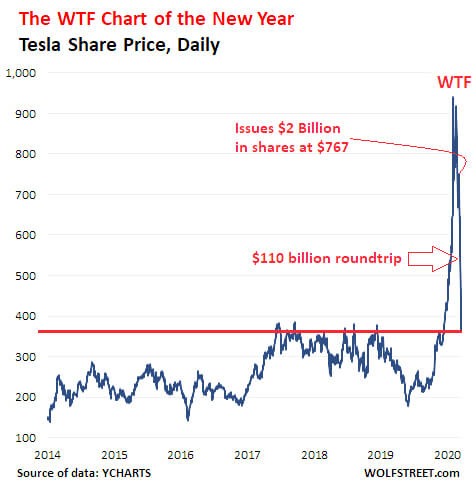

You’ve wanted to admire Musk for snookering true believers into purchasing for $2 billion of newest shares a month previous that sq. measure at present down 52.

Tesla Inc (TSLA) Live

About Tesla, Inc.

Primarily based in 2003, the company designs, develops, manufactures, and markets high-performance, technologically superior electrical autos and solar energy expertise and energy storage merchandise. Tesla sells larger than 5 absolutely electrical autos, amongst others, the Model S sedan and the Model X SUV, and the Model 3 sedan, which is among the many many world’s top-selling electrical autos. The fuel-efficient, completely electrical autos recharge their lithium-ion batteries from an outlet. Tesla’s Autopilot self-driving experience {hardware} has been obtainable on all Tesla fashions since late 2016. US prospects generate larger than half of Tesla’s product sales. CEO Elon Musk co-founded PayPal and as well as, runs SpaceX.

Operations

Tesla operates in two reportable segments: Automotive and Power expertise and storage.

The automotive section generates about 85% of product sales. The section incorporates product sales and leasing {of electrical} autos along with product sales of automotive regulatory credit score. Its totally different electrical autos are Model Y, Cybertruck, Tesla Roadster, and Tesla Semi. Furthermore, the section will also be comprised of corporations and others. It accounts for practically 10% of product sales and incorporates non-warranty after-sales car corporations, product sales of used autos, retail merchandise, product sales by the acquired subsidiaries to third-party prospects, and car insurance coverage protection earnings.

The company’s energy expertise and storage section (merely over 5% of earnings) make and sells stationary energy storage merchandise and photovoltaic energy strategies to residential and small industrial prospects. Its Powerwall lithium-ion battery with built-in inverter system is designed to retain energy at residence or in small industrial facilities. Tesla’s industrial, industrial, and utility offering, Powerpack and Megapack, is an influence storage system that may be blended with renewable energy expertise sources to create microgrids. Megapack moreover affords choices like grouping a lot of fashions to kind a much bigger setup capable of reaching gigawatt hours or higher. Tesla’s photovoltaic energy strategies embody photovoltaic panels, inverters, and rack strategies. The company photo voltaic Roof gathers solar energy from glass tiles that function to be additional architecturally pleasing than standard roof-mounted photo voltaic panels.

Geographic Attain

Tesla, headquartered in Palo Alto, California, operates manufacturing facilities in Fremont, and Lathrop, California; Tilburg, the Netherlands; and its Gigafactories near Reno, Nevada, Buffalo, New York, Berlin, Germany, and Shanghai, China. Energy storage merchandise is manufactured at its Gigafactory Nevada. photo voltaic merchandise is made primarily at Tesla’s Gigafactory in Buffalo, New York. The US accounts for larger than 50% of product sales. Completely different markets for which the company breaks out product sales embody China (over 10% of product sales), the Netherlands (larger than 5%), and Norway (about 5%). The remainder is generated by totally different worldwide places for about 25% of product sales.

Gross sales and Promoting

Tesla markets and sells autos to prospects by means of an web web site and a worldwide neighborhood of company-owned outlets and galleries. Tesla is notable in that it would not use dealerships (due, in some states, to approved restrictions). The company moreover affords a used car enterprise that helps new car product sales by integrating product sales of current Tesla autos with purchaser’s trade-in needs for his or her car. The company consistently builds networks of Supercharger and Trip spot Charging stations in Australia, Canada, China, France, Germany, Italy, Japan, Russia, South Korea, U.A.E., U.Okay., U.S., and in roughly larger than 40 worldwide places that give fast, helpful charging locations for Tesla householders to recharge their autos.

The company’s photovoltaic energy and storage merchandise are often purchased on to residential prospects by means of the company’s outlets and galleries, and via channel companions domestically. A world product sales group and neighborhood of channel companions market and promote Powerwall on to utilities, Powerpack, and Megapack strategies to industrial and utility prospects.

Tesla’s selling costs had been $27 million, $32 million, and $37 million for the years 2019, 2018, and 2017, respectively.

Monetary Effectivity

Tesla’s earnings progress has accelerated like its first automotive, the Roadster sports activities actions automotive (0-60 in 1.9 seconds), pushed by the rising number of autos purchased yearly. Between 2015 and 2019 product sales have grown a whopping 507%. The company, nonetheless, has posted a string of web losses as a result of it pours money into evaluation and enchancment, and manufacturing.

Tesla’s earnings jumped 15% to $24.6 billion in 2019 pushed by an 87% enchancment in automotive earnings. This was primarily because of bettering automotive product sales earnings by $2.32 billion, or 13%, throughout the 12 months ended December 31, 2019, as as compared with the 12 months ended December 31, 2018.

The company misplaced about $862 million in 2019, which was an enhancement over the $976 million misplaced in 2018.

Cash on the end of 2019 was $6.8 billion, an increase of about $2.5 billion from the prior 12 months. Cash from operations contributed $2.4 billion to the coffers, whereas investing actions used $1.4 billion, primarily for capital expenditures. Financing actions generated $1.5 billion, primarily inside the kind of proceeds from issuances of convertible and totally different debt.

Approach

To help meet that function and ramp up product sales in overseas markets, Tesla’s Gigafactory 3 in Shanghai, China began establishing autos in late 2019. Model 3s rolling out of Gigafactory 3 is pivotal to Tesla’s play on the planet’s largest electrical automotive market and may help it to accumulate ground in China whereas avoiding import tariffs. Shortly after the opening of Gigafactory 3, Tesla launched it might assemble its subsequent Gigafactory in Germany exterior Berlin. A producing base in Germany is anticipated to steer clear of the problems of exporting autos to Europe.

Tesla will also be busy advancing its autonomous automotive experience. The company Autopilot driver-assist system incorporates auto-steering, traffic-aware cruise administration, automated lane altering, and totally different choices that collectively provide total self-driving experience whereas defending the driving force in last administration of the automotive.

Mergers and Acquisitions

In late 2019, Tesla acquired Canada-based Hibar Strategies Ltd., a producer of battery strategies for electrical vehicles, laptops, and totally different merchandise. Commerce watchers think about the deal is part of Tesla’s approach to establish its private battery cell manufacturing functionality.

In late 2019, Tesla bought the computer imaginative and prescient start-up DeepScale based in Mount View, California. DeepScale’s experience helps automakers use low-wattage processors to power very right laptop computer imaginative and prescient. The acquisition of DeepScale is anticipated to hurry up Tesla’s autonomous driving experience efforts.

In early 2019, Tesla acquired energy experience agency Maxwell Utilized sciences, Inc. in an all-stock deal valued at larger than $200 million. Maxwell, based in San Diego, California, develops and makes ultracapacitors, devices that will retail and quickly ship surges of energy. Tesla would use Maxwell’s dry electrode experience that will have a extremely huge impression on the company.

Agency Background

Tesla Motors is called Nikola Tesla (1856-1943), the famed Serbian-American engineer and inventor. Tesla Motors was included in July 2003.